Schemes & Benefits

Pradhan Mantri Awas Yojna

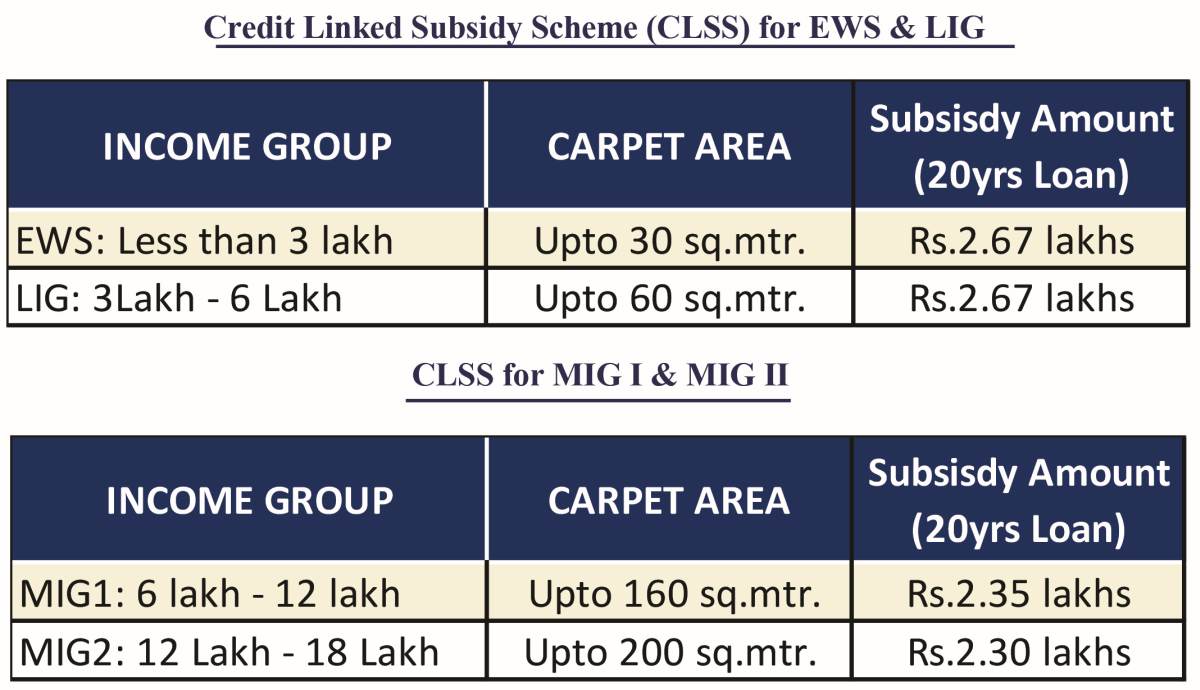

Women Ownership is mandatory for EWS/LIG category.

- The CLSS Scheme for MIG1 & MIG2 is valid till 31/03/2020.

- The CLSS Scheme for EWS/LIG is valid till 31/03/2022.

- Aadhar number(s) of the beneficiary family are mandatory for MIG category.

- The interest subsidy will be available for maximum loan tenure of 20 yrs or the loan tenure whichever is lower.

- The interest subsidy will be credited upfront to the loan account of beneficiaries through the lending bank resulting in reduced effective housing loan and Equated Monthly Instalment (EMI).

- A beneficiary family will comprise husband, wife, unmarried sons and/ or unmarried daughters. The beneficiary family should not own a pucca house (an all weather dwelling unit) either in his/her name or in the name of any member of his/her family in any part of India.

- As per amendment dated 15.03.2018, an adult earning member (irrespective of marital status) can be treated as a separate household. Provided also that in case of a married couple, either of spouses or both together in joint ownership will be eligible for a single house, subject to income eligibility of the household under the scheme.

- EWS/LIG – Interest Rate Subsidy of 6.5% for a loan amount up to Rs.6,00,000

- MIG 1 - Interest Rate Subsidy of 4% for a loan amount up to Rs.9,00,000

- MIG 2 - Interest Rate Subsidy of 3% for a loan amount up to Rs.12,00,000

- The additional loan beyond the specified limits, if any to be at non -subsidized rate.

- There is no cap on the loan amount or the cost of the property.

Benefits

Tax Deduction on Home Loans

Homeowners can claim a deduction of up to Rs 2 lakh on their home loan interest, if the owner or his family resides in the house property. The same treatment applies when the house is vacant. If you have rented out the property, the entire home loan interest is allowed as a deduction.

However, your deduction on interest is limited to Rs. 30,000 instead of Rs 2 lakhs if any of the following conditions are satisfied:

Condition I

- The loan is taken on or after 1 April 1999, and

- The purchase or construction is not completed within 5 years from the end of the FY in which loan was availed.

Condition II

- The loan is taken before 1 April 1999.

Condition III

- The loan is taken on or after 1 April 1999 for the purpose of repairs or renewal of the house property.

When is the deduction limited to Rs 30,000?

As already mentioned, if the construction of the property is not completed within 5 years, the deduction on home loan interest shall be limited to Rs. 30,000. The period of 5 years is calculated from the end of the financial year in which loan was taken. So, if the loan was taken on 30th April 2015, the construction of the property should be completed by 31st March 2021. (For years prior to FY 2016-17, the period prescribed was 3 years which got increased to 5 years in Budget 2016). Note: Interest deduction can only be claimed, starting in the financial year in which the construction of the property is completed.

How do I claim a tax deduction on a loan taken before the construction of the property is complete?

Deduction on home loan interest cannot be claimed when the house is under construction. It can be claimed only after the construction is finished. The period from borrowing money until construction of the house is completed is called pre-construction period. Interest paid during this time can be claimed as a tax deduction in five equal instalments starting from the year in which the construction of the property is completed.

b. Tax Deduction on Principal Repayment

The deduction to claim principal repayment is available for up to Rs. 1,50,000 within the overall limit of Section 80C. Check the principal repayment amount with your lender or look at your loan instalment details.

Conditions to claim this deduction-

- The home loan must be for purchase or construction of a new house property.

- The property must not be sold in five years from the time you took possession. Doing so will add back the deduction to your income again in the year you sell.

Stamp duty and registration charges Stamp duty and registration charges and other expenses related directly to the transfer are also allowed as a deduction under Section 80C, subject to a maximum deduction amount of Rs 1.5 lakh. Claim these expenses in the same year you make the payment on them.

c. Section 80EEA – Deduction for interest paid on home loan for affordable housing

Eligibility criteria

The deduction under this section is available only to individuals. This deduction is not available to any other taxpayer. Thus, if you are a HUF, AOP, partnership firm, company, or any other kind of taxpayer, you cannot claim any benefit under this section.

Amount of deduction

A deduction for interest payments up to Rs 1,50,000 is available under Section 80EEA. This deduction is over and above the deduction of Rs 2 lakh for interest payments available under Section 24(b) of the Income Tax Act.

Read more about the deduction of Rs 2 lakh on interest on home loan here.

Therefore, taxpayers can claim a total deduction of Rs 3.5L for interest on home loan, if they meet the conditions of section 80EEA.

Other conditions

Similar to Section 80EE, in order to claim deduction under Section 80EEA, you should not own any other house property on the date of the sanction of a loan.

Conditions for claiming the deduction

- Housing loan must be taken from a financial institution or a housing finance company for buying a residential house property.

- The loan should be sanctioned during the period 1st April 2019 and 31st March 2022.

- Stamp duty value of the house property should be Rs 45 lakhs or less.

- The individual taxpayer should not be eligible to claim deduction under the existing Section 80EE.

- The taxpayer should be a first-time home buyer. The taxpayer should not own any residential house property as on the date of sanction of the loan.

Conditions with respect to the carpet area of the house property. These conditions have been specified in the memorandum to the finance bill, but not mentioned in section 80EEA:

- The carpet area of the house property should not exceed 60 square meter ( 645 sq ft) in metropolitan cities of Bengaluru, Chennai, Delhi National Capital Region (limited to Delhi, Noida, Greater Noida, Ghaziabad, Gurgaon, Faridabad), Hyderabad, Kolkata and Mumbai (whole of Mumbai Metropolitan Region)

- Carpet area should not exceed 90 square meter (968 sq ft) in any other cities or towns.

- Further, this definition will be effective for affordable real estate projects approved on or after 1 September 2019

Section 80EEA has been introduced to further extend the benefits allowed under Section 80EE for low-cost housing. Earlier, Section 80EE had been amended from time to time to allow a deduction for interest paid on housing loan for the FY 2013-14, FY 2014-15, and FY 2016-17.

The section does not specify if you need to be a Resident to be able to claim this benefit. Therefore, it can be concluded that both Resident and Non-Resident Indians can claim this deduction.

The section also does not specify if the residential house should be self-occupied to claim the deduction. So, borrowers living in rented houses can also claim this deduction. Moreover, the deduction can only be claimed by individuals for the house purchases jointly or singly. If a person jointly owns the house with a spouse and they both are paying the instalments of the loan, then both of them can claim this deduction. However, they must meet all the conditions laid down.

Apun Ghar Home Loan Scheme

The Government of Assam has initiated a housing scheme known as Apon Ghar Home Loan scheme to provide home loan for state government employee on subsidized interest rates.

Benefits

Under the home loan scheme, the eligible beneficiaries who are permanent residents and employee of State Government can avail a subsidised loan from State Bank of India of Rs.15 Lakhs (Rs.30 Lakhs for joint State Government Employee borrowers) and any additional amount would be at non -subsidised rate. Assam Government would provide 1% interest subvention for the same.

Eligibility

The eligible applicant applying under this scheme should meet the following eligibility criteria.

- The applicant should be a State Government employee.

- Repayment up to 20years.

- Permanent Employees with Minimum 5 years of residual service is mandatory.

- No TIR, No Valuation and Processing Fees

- Applicable for loan application made before 31-03-2023.

Apunar Apun Ghar Yojana

Apunar Apun Ghar Home Loan Scheme Assam has been launched by the State Governemnet for the permant residents of Assam. Applicants can apply online through the official website of government finance.assam.gov.in

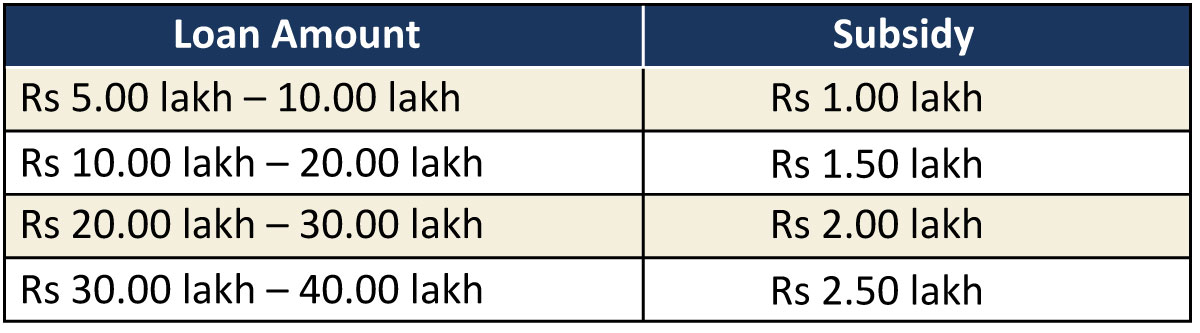

Under this Scheme, the Assam government will provide subsidy on home loan to every permanent resident of Assam up to Rs 2.5 lakh on home loans till Rs 40 lakh.

Benefits

Eligibility

The eligible applicant applying under this scheme should meet the following eligibility criteria.

- Applicant should be a permanent resident of Assam.

- This must be first home of the composite family.

- Housing loan from any Scheduled Commercial Bank, Regional Rural Bank, Assam Cooperative Apex Bank within the state.

- Composite Family Income less than INR 20 Lakhs.

- Housing Loans of more than Rs. 5 lakhs and sanctioned by Bank on or after 1 st April 2019 and before the scheme end date.

- Those already benefited under "Apon Ghar" Scheme are not eligible for this subsidy.

- Loan accounts must not be under NPA (Non Performing Asset) Status.

- Kindly check the validity of the scheme with the respective banks.

Note: Assessment of your eligibility to avail the benefits of Apun Ghar and Aapunar Apun Ghar scheme is at the sole discretion of the Government of Assam. Contents herein are parameters outlined under the scheme for assessment of entitlement.